EIS / SEIS Loss Relief explained

You have invested in an EIS program and realized the worst has happened; you have lost your entire investment in a company failure!

EIS Loss relief combined with the total tax relief system of the EIS program mitigates your total loss to a fairly manageable rate. This article will discuss how you should maximize your loss mitigation opportunities so that in the worst case scenarios your total loss is within acceptable ranges.

EIS Loss Mitigation

Before we talk about actual worst case scenarios, you need to understand how loss mitigation can stack up in an EIS.

The Enterprise Investment Scheme (EIS) was developed by HMT (Her Majesty’s Treasury) as a way to promote, develop and grow small and medium sized businesses in their start-up and growth phases. In return, investors that take these risks are rewarded with a number of tax relief opportunities in connection with the EIS.

Income Tax Relief

Income tax relief is provided against your income tax liability in the year the EIS shares were purchased or for one carry back year. You can claim 30% of the cost of the EIS shares up to a maximum of £1 million.

Capital Gains Reinvestment/Deferral Relief

If you are investing capital gains, in the same year an asset was liquidated, into a qualifying EIS company, the capital gains on that asset is waived. A value of up to 28%.

Capital Gains Tax Exemption

If you have held the EIS shares for 3 years and then liquidate those shares, the capital gains tax of up to 20% is relieved.

Loss Relief

If your shares in an EIS company become worthless, because of company failure, the net loss after the income tax relief is removed can be applied against your taxable income in the year the loss is realized or in the previous year to the loss. This equates to a potential 45% value to those in the highest tax bracket.

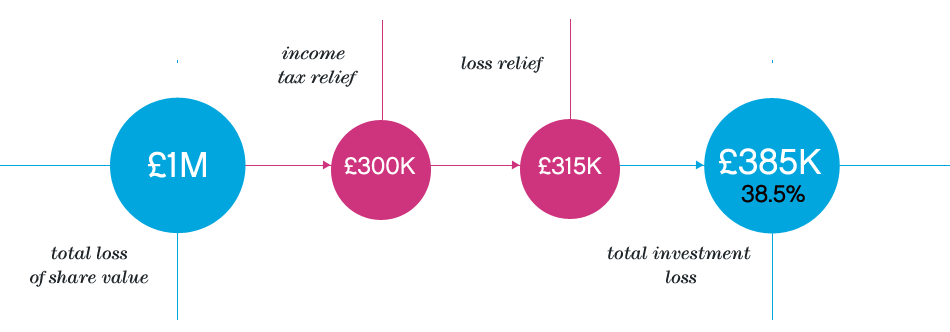

Top Tax Bracket 100% Loss Case Study

The top earners in the UK can benefit from the EIS program in the largest monetary amount simply because of the loss relief provided in the event of a total loss on their investment and their high income tax bracket.

Consider Miss Harding, a wealthy entrepreneur that earns £3 million a year on current business ventures and looks for a way to mitigate her 45% tax liability. £1 million of that income can be invested into an EIS with a resulting 30% income tax relief for that same year. If that income was invested from the sale of an asset, she could also receive up to 28% CGT deferral on top of the income tax relief.

Yet, what happens if the total investment is lost due to a financial catastrophe and the closing of the EIS company? See below for an actual accounting of the investor’s total loss:

- £1,000,000 invested

- £300,000 received as income tax relief

- Total Loss of Share Value, £1,000,000 – £300,000 Income Tax Relief Equals a loss of £700,000

- Applied to her income that year at a 45% tax bracket allows a £315,000 tax relief

- Income Tax Relief and Loss Relief equal £615,000. In addition, there is the CGT Deferral of up to £280,000

- Total Investment loss = £385,000 or only 38.5%

In this scenario, this aggressive investor was able to reclaim taxes to recover the lost share value and only come up roughly 38.5% short in their total investment.

In this scenario, this aggressive investor was able to reclaim taxes to recover the lost share value and only come up roughly 38.5% short in their total investment.

N.b. The business failure would trigger a capital gain meaning that unless Miss Harding reinvests in a further EIS, she would then have to pay CGT on her gain on the 31st January following the tax year in which the loss occurred.

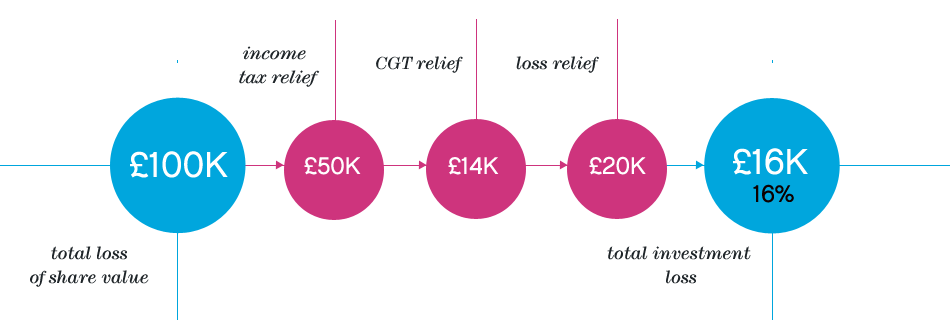

Middle Tax Bracket, Worst Case Scenario

If you are in the middle tax bracket at 40%, would a worst case scenario SEIS investment failure still be as risk averse as the example above? Seed EIS’s allow a greater 50% income tax relief, and £100,000 maximum annual investment, but otherwise are very similar to EIS.

In this example a professional earns £145,000 a year and is taxed at 40%, equating to a £58,000 tax liability. Instead the professional decides to invest £100,000 into an SEIS to reduce his tax liability. See how a worst case scenario works out for him, below:

- £100,000 invested

- £50,000 received for income tax relief

- £14,000 CGT relief (based on £100k gain on property)

- Total Share loss of £100,000 which gives rise to a £50,000 loss relief claim netting a £20,000 tax rebate

- £16,000 total cost of the SEIS loss or 16%.

This overall outcome is even more attractive that the above example.

This overall outcome is even more attractive that the above example.

The best bit of this is when you build a diversified portfolio. If you have a good spread of say 30 investments, you expect some to fail, but equally some to fly. The best bit is that the ones that fail deliver the returns outlined above, while those that fly enjoy tax free returns. A win:win scenario.

Talk to a professional financial advisor and see if an EIS or SEIS investment is right for your portfolio today.